Update On Government Petitions Regarding Pension Reform

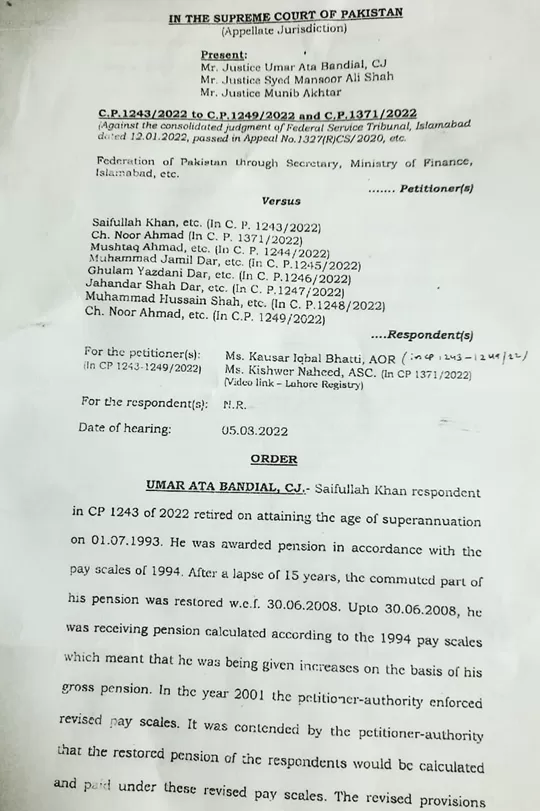

Constitutional Petitions for Leave to Appeal [CPLA] No.1243/2022 etc., filed by the Government of Pakistan in opposition to the rulings issued by the Federal Service Tribunal Islamabad in Appeal No.1327(R)/CS/2020, etc. on January 12, 2022, were dismissed by the Supreme Court [SC] of Pakistan on August 5, 2022.

Prior to 2001, pensioners had filed an appeal with the Federal Service Tribunal (FST) requesting the government to continue paying pension increases on Gross Pension in accordance with the 1994 (pre-2001) pay scale rulings.

They claimed that the Government had wrongfully imposed the 2001 pay scales and pension system on them (which went into effect on December 1, 2001), refusing an increase on the relinquished or commuted portion of the pension, which resulted in losses.

Also Read: Government of Pakistan Introduces New Pension Rules for Government Employees

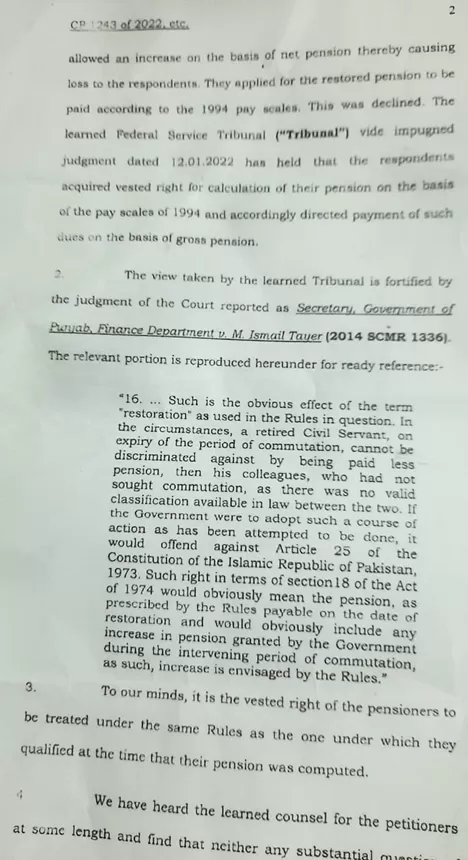

The Federal Service Tribunal determined that the aforementioned retirees had acquired the vested right to have their pensions calculated using the pay scales in 1994 and ordered the government to pay their pension contributions using that exact formula for gross pension. The government then brought many CPLAs to challenge the FST orders.

SCP Hearing and FST Orders

On August 5, 2022, the Supreme Court reviewed the CPsLA and affirmed Federal Service Tribunal rulings that pensioners have a vested right to be handled according to the same (pre-2001) regulations as those that had allowed them to qualify for a pension.

Also Read: Adhoc Relief Allowance Notification 2023 @ 35% of Basic Pay and Pension for Local Government

The Supreme Court noted that the Tribunal is the highest forum for determining facts and that it can only take up a case if it involves a material question of law of public interest. Since the petitions did not specify any such serious matter of law, they were rejected, and leave was also denied.

Pension increases up to and including July 1, 1999, were calculated based on the total of the original gross pension amount before any surrender or commutation and the cumulative sum of all previous increases received.

Since 1.12.2001, pension increases have only been permitted on Net Pension (gross pension less relinquished or commuted share) plus prior increases. This practice was imposed on pensioners who had retired in 1994 (and other pre-2001) pay scales and under pertinent pension regulations and orders through Paragraph 16 of Finance Division O.M. No. F.1 (5) Imp/2001 dated 4.9.2001.

According to the aforementioned sub-paragraph, “In the future, any rise in the pensioners will be based on Net Pension, rather than Gross Pension.”

Pre-2021 Pensioners

According to the pre-2001 pensioners, they still have a right to increases to their gross pension plus prior increases. Only those who: either joined government service after December 1, 2001; selected the 2001 pay scales cum pension scheme; or retired after July 1, 2001, but accepted the 2001 scheme are subject to the transition [from increases in Gross Pension to increases in Net Pension].

Pre-2001 pensioners repeatedly asked the Finance Division to continue raising the Gross Pension plus prior increases, but they were denied. Then, the disgruntled pensioners appealed to the Federal Service Tribunal for appropriate guidance to the executive branch. Following FST’s acceptance of their appeals, the government was instructed to keep granting increases to the pre-2001 retirees receiving a gross pension.

The refusal of increases on the commuted portion of pension from 1.12.2001 till the date of restoration resulted from imposing the 2001 scheme on the pre-2001 pensioners. The actual short payment of pension remained from 1.12.2001 until the date of restoration, even though the government subsequently permitted such increases on a Notional basis starting from that date.

Mr. X, a retiree, reveals how his pension was underpaid from December 1, 2001, to July 5, 2012, as a result of incorrectly determining increases in Net Pension (instead of Gross Pension).

He retired on August 8, 1997, receiving a gross pension of Rs. 14,499. On August 8, 2012, his commuted 50% pension was reinstated. The gross pension amounts that would have been paid (including the net and commuted portions) if all increases from 2001 to 2011 had been permitted are explained below.

- On 8-May-97:

-

- Net Payment: 7,249.50

- Commuted Payment: 7,249.50

- Total Payment: 14,499.00

- Increases from 2001 to 2011:

-

- Net Payment: 28,461.08

- Commuted Payment: 28,461.08

- Total Payment: 56,922.16

- On 8.5.2012:

-

- Net Payment: 35,710.58

- Commuted Payment: 35,710.58

- Total Payment: 71,421.16

Mr. X was paid all increases from 2001 to 2011 on Net Pension alone (denied / not paid on the Commuted part of a pension) as a result of the 2001 Pay Scales Cum Pension Scheme being illegally enforced on the 1994 and other pre-2001 pensioners. Due to this, Mr. X received a shorter pension payment from 2001 to 2011 as shown below.

- On 8-May-97:

-

- Net Payment: 7,249.50

- Commuted Payment: 7,249.50

- Total Payment: 14,499.00

- Increase in 1999:

-

- Net Payment: 1,449.90

- Commuted Payment: 1,449.90

- Total Payment: 2,899.80

- Increases from 2001 to 2011:

-

- Net Payment: 27,011.18

- Commuted Payment: 4,501.86

- Total Payment: 31,513.05

- On 8.5.2012:

-

- Net Payment: 35,710.58

- Commuted Payment: 13,201.26

- Total Payment: 48,911.85

Mr. X and several hundred similarly situated pensioners now anticipate that the government will actually grant increases to commuted pensions rather than just on a theoretical or suppositional basis.