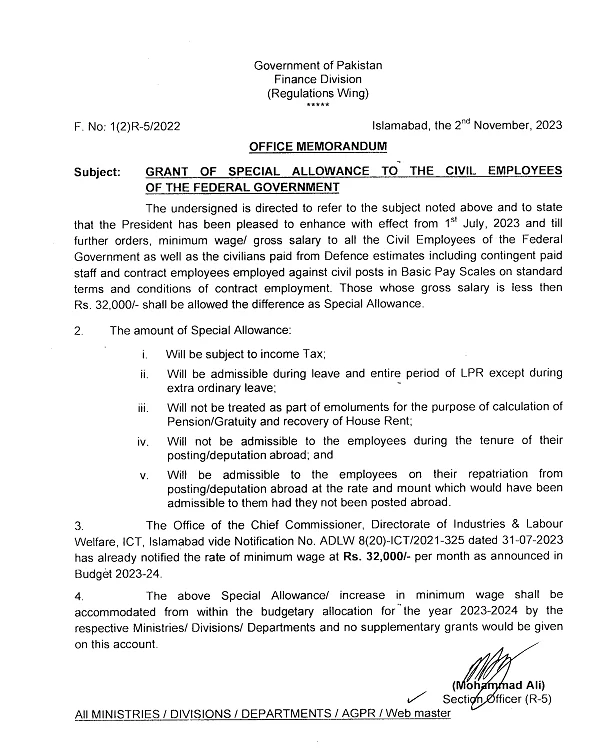

On November 2, 2023, Pakistan’s Finance Division (Regulations Wing) announced a significant development by implementing a Special Allowance for federal employees earning less than Rs. 32,000 per month.

This project aims to give critical financial assistance to low-income public servants around the country. The change is expected to reduce the financial burden on this group while also providing much-needed support and assistance.

The Finance Department of the Pakistani government has approved the payment of Special Allowance to Federal Government Civil Employees. The President of Pakistan has authorized and sanctioned this exceptional allowance, which will take effect on July 1, 2023.

The following are the requirements for the Special Allowance:

It is permissible during leave and throughout the duration of LPR, except for special leaves, and will be taxable as income.

This allowance won’t be taken into account for determining enrollment, nor will it be utilized to figure out pension gratuities or recoup unpaid rent.

Employees posting and deputing overseas will not be eligible for it; but, upon their return, it will become applicable at the same rate and amount as if they had not been posted overseas.

As part of the budget for 2023–2024, the Office of the Chief Commissioner, Directorate of Industries, and Labour Welfare ICT Islamabad have also released a notification, establishing the minimum wage rate for the employees of the Islamabad Capital Territory at Rs. 32,000 per month.

It’s important to remember that the budgetary allocation for the fiscal year 2023–2024 will account for the rise in the Special Allowance for workers whose gross incomes fall below Rs. 32,000.

No additional funding will be given to the corresponding departments, ministries, or divisions for this purpose.

The Finance Division’s declaration and ICT’s notification guarantee that Pakistan’s low-income government employees will get the much-needed financial assistance to raise their level of living.

This Special Allowance helps those who are having financial difficulties by basing eligibility on gross earnings, which includes basic pay and any allowances.