On October 17, 2023, the Finance Department of the Government of Punjab released a notification regarding the revision rates for the 2023 Punjab Daily Allowance, Traveling Allowance, and Mileage Allowance. These new TA/DA rates in Punjab come into effect on July 1st, 2023. The specifics are as follows:

Revision Daily Allowance Rates Punjab, TA & Mileage (TA/DA)

As a follow-up to this department’s letters FD Sr. -1-9-/2010 dated January 1, 2013, and FD-SR-1/ 8-2/2015 dated July 18, 2017. The responsible authority is glad to change the days on which government employees and other officials are now eligible for daily allowances.

With effect starting on July 1st, 2023, rates are applied for official duty performed within the nation as well as travel and mileage reimbursement. The Finance Division of the Government of Pakistan has already published the Notification of the Revised Daily Allowance 2023 Federal on October 8, 2023.

Also Read: Sindh Minimum Wages Notification 2023 has been Issued

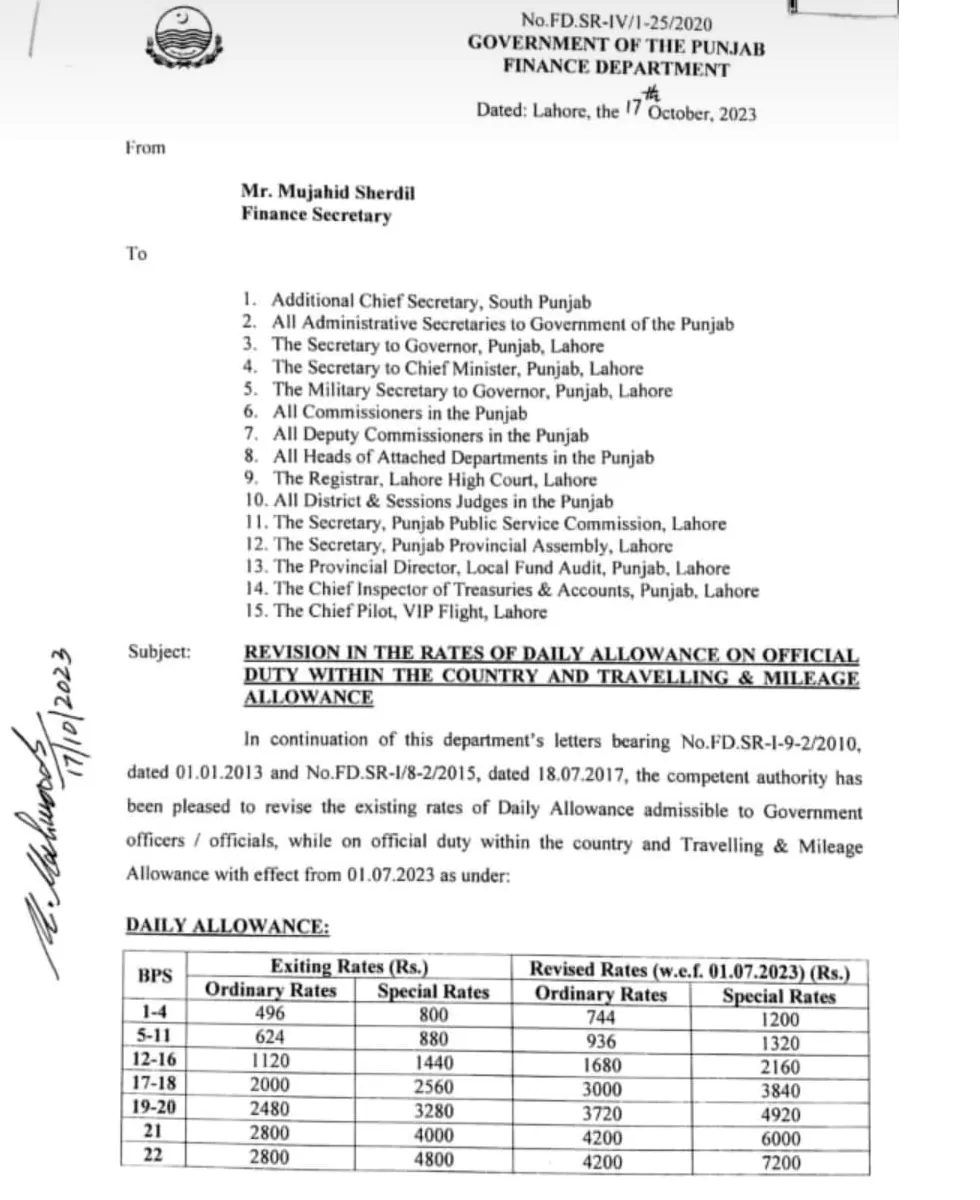

Detail of Current Existing Rates and New Revised Rates TA/DA

Here are the existing and revised Travel Allowance (TA) and Daily Allowance (DA) rates for different Basic Pay Scales (BPS):

- For BPS-01 to BPS-04, the existing ordinary rate is Rs. 496, and the special rate is Rs. 800. The revised ordinary rate is Rs. 744, while the special rate is Rs 1200.

- Moving on to BPS-05 to BPS-11, the existing ordinary rate is Rs. 112, and the special rate is Rs. 1440. In the revised rates, the ordinary rate increases to Rs. 1680, and the special rate goes up to Rs. 2160.

- In the BPS-12 to BPS-16 category, the existing ordinary rate is Rs. 2000, and the special rate is Rs. 2560. Under the revised rates, the ordinary rate increases to Rs. 3000, and the special rate rises to Rs. 3840.

- For BPS-17 to BPS-18, the existing ordinary rate stands at Rs. 2480, with the special rate at Rs. 3280. In the revised rates, the ordinary rate becomes Rs. 3720, and the special rate increases to Rs. 4920.

- In the BPS-19 to BPS-20 category, the existing ordinary rate is Rs. 2800, and the special rate is Rs. 4000. Under the revised rates, the ordinary rate increases to Rs. 4200, while the special rate goes up to Rs. 6000.

- Lastly, for BPS-21, the existing ordinary rate is Rs. 2800, and the special rate is Rs. 4800. In the revised rates, the ordinary rate remains the same at Rs. 4200, but the special rate increases to Rs. 7200.

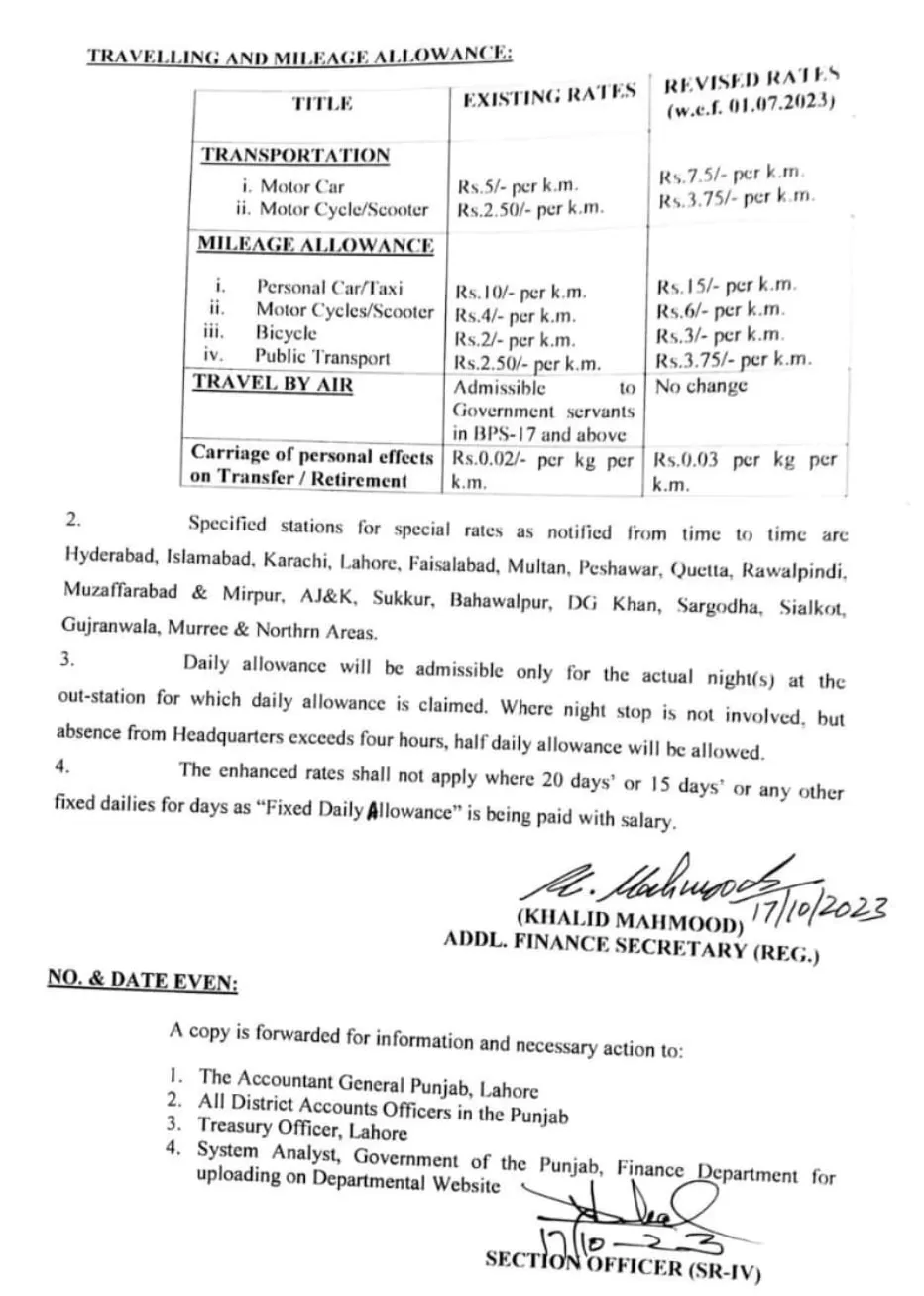

Rates of Travelling and Mileage Allowance

The details of revised rates of traveling and mileage allowance 2023 for Punjab are as follows:

Transportation Allowance:

- Motor Car:

- Existing Rate: Rs. 5 per kilometer.

- Revised Rate: Rs. 7 per kilometer.

- Motor Cycle / Scooter:

- Existing Rate: Rs. 2.50 per kilometer.

- Revised Rate: Rs. 3.75 per kilometer.

Mileage Allowance:

- Personal Car/Taxi:

- Existing Rate: Rs. 10 per kilometer.

- Revised Rate: Rs. 15 per kilometer.

- Motor Cycle / Scooter:

- Existing Rate: Rs. 4 per kilometer.

- Revised Rate: Rs. 6 per kilometer.

- Bicycle:

- Existing Rate: Rs. 2 per kilometer.

- Revised Rate: Rs. 3 per kilometer.

- Public Transport:

- Existing Rate: Rs. 2.50 per kilometer.

- Revised Rate: Rs. 3.75 per kilometer.

Traveling Through Air (Admissible to Government Servants in BPS-17 and above):

- Existing Rate: Rs. 0.03 per kilogram per kilometer.

Special Stations for Special Rates

Hyderabad and Islamabad are the stations that are designated for the periodic notification of special rates. The northern regions include Azad Jammu and Kashmir, Bahawalpur, Sukkur, DG Khan, Sargodha, Sialkot, Gujarat, Multan, Faisalabad, Quetta, Peshawar, Rawalpindi, Muzaffarabad, and Mirpur.

Also Read: Adhoc Relief Allowance Notification 2023 @ 35% of Basic Pay and Pension for Local Government

Only nights spent at the outstation that are actually covered by the daily allowance are admissible. If not, the night stop is not relevant; nonetheless, a half-day’s pay will be permitted if the absence from headquarters lasts longer than four hours. Where 20 days, 15 days, or any other fixed daily for days as fixed daily Allowance is being provided with the wage, the additional states are not applicable.